CIPC Companies Enforcement Compliance Checklist: Statutory Disclosures

Explanatory analysis and compliance audit on the CIPC’s mandatory 24 Companies Act sections and regulations

R

750.00

( R652.17 Excl VAT )

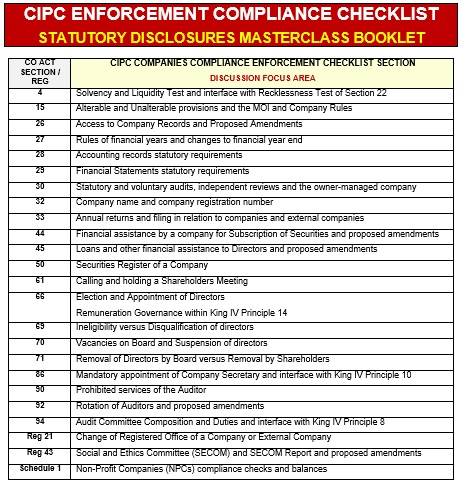

In the light of increasing corporate misgovernance and accounting irregularities, CIPC requires ALL companies including Private Profit, Non-Profit (NPC) and Incorporated / Personal Liability (Inc) companies before they submit their Annual Returns to confirm their compliance in relation to 24 specified Sections and Regulations of Companies Act, Act 71 of 2008.

- FRAMEWORK OF THE COMPANIES ACT STATUTORY REQUIREMENTS

- DISCUSSION OF PRINCIPAL FOCUS AREAS PER SECTION AND KEY EVIDENTIAL DOCUMENTATION

- CLEAR UNDERSTANDING OF THE SPECIFIC COMPLIANCE ISSUES PER SECTION

- EXAMPLE OF SPECIFIC DECLARATIONS AND RESOLUTIONS FOR EVERY APPLICABLE CIPC COMPLIANCE SECTION BY DIRECTORS AND PRESCRIBED OFFICERS

- PENALTIES FOR FALSE DECLARATIONS AND STATEMENTS TO THE COMMISSION AND NON-COMPLIANCE

- APPLICABLE CORPORATE TESTS TO BE UNDERTAKEN

- RISK EXPOSURE AREAS FOR THE PROFESSIONALS, NAMELY: ACCOUNTANTS, AUDITORS, CORPORATE ATTORNEYS AND COMPANY SECRETARIAL TO BE MITIGATED

Specifications

| A 4 | |

| ~ 550 pages |